The vibrant landscape of exchange-traded funds (ETFs) provides investors with a diverse array of options to construct their portfolios. Among these, S&P 500 sector ETFs have emerged as a prominent choice, offering exposure to specific industries of the U.S. economy. By investing in these ETFs, investors can leverage the potential of individual sectors while mitigating overall portfolio risk.

- Moreover, understanding the unique characteristics of each sector is essential for investors to make savvy decisions.

- Sector ETFs can provide a clear way to track the performance of specific industries, such as technology, healthcare, or consumer discretionary.

Nonetheless, it is essential to note that sector ETFs are not without risk. Their performance can be highly volatile and responsive to changes in macroeconomic conditions, industry cycles, and regulatory initiatives.

Harnessing the Power of S&P 500 Sector ETFs: Identifying Leading Sectors

In the dynamic world of investments, pursuing growth opportunities has always been a top priority for savvy investors. Explore S&P 500 sector ETFs as a powerful tool to allocate your portfolio and potentially maximize returns. These ETFs focus on specific industry sectors within the prestigious S&P 500 index, allowing investors to specialize their exposure to promising areas of the market.

Scrutinizing recent performance trends reveals robust stories within multiple sectors. {Technology, Healthcare, and Consumer Discretionary have emerged as consistent performers, driven by innovation, technological advancements, and evolving consumer preferences|sectors like Technology, Healthcare, and Consumer Discretionary have consistently outperformed, fueled by innovation, technological advancements, and shifting consumer demands|Technological breakthroughs, healthcare innovations, and changing consumer habits have propelled sectors like Technology, Healthcare, and Consumer Discretionary to the forefront.

- Understanding the intrinsic drivers of these sectors is crucial for making informed investment decisions

- Consider the economic factors that shape sector performance.

- Stay informed on industry news and regulatory developments that could influence sector outlooks.

{Bythoughtfully selecting S&P 500 sector ETFs that align with your risk tolerance, you can potentially unlock growth potential. Remember, diversification is key to mitigating risk and navigating market volatility.

Navigating the Market: The Best S&P 500 Sector ETFs for Your Portfolio

Successfully allocating in the stock market requires a well-rounded portfolio. One reliable method to achieve this is by incorporating ETFs that track specific sectors within the S&P 500 index. The S&P 500, a benchmark of the top-performing U.S. companies, offers exposure to diverse industries, allowing investors to exploit growth trends across various sectors.

Consider some of the top-performing S&P 500 sector ETFs that can enhance your portfolio:

- Banking ETFs: Provide exposure to companies in the financial services industry, including banks, insurance providers, and investment firms. These ETFs can be influenced by economic growth and interest rate movements.

- Hardware ETFs: Track companies involved in technology development, manufacturing, and services. This sector is known for its innovation, making it an attractive option for investors seeking significant growth.

- Biotech ETFs: Offer exposure to companies involved in the healthcare industry, ranging from pharmaceutical research to medical devices. This sector tends to be stable due to its fundamental role in society.

Remember this is not an exhaustive list, and it's important to conduct your own research before making any investment decisions. Seeking advice from a qualified financial advisor can also be beneficial.

Diversify Your Portfolio: Why Invest in S&P 500 Sector ETFs?

Seeking to boost your portfolio's performance? Consider the power of sector specialization. Investing in S&P 500 sector ETFs offers a strategic way to participate in specific industry sectors, allowing you to check here customize your investments to align your financial objectives.

Harnessing the strength of sector ETFs provides several perks: increased asset allocation, potential for enhanced gains, and industry concentration.

- Explore the performance of various sectors to discover promising opportunities.

- Select ETFs that represent your desired sectors and risk appetite.

- Assess your ETF holdings regularly to optimize your portfolio based on market dynamics.

Analyzing S&P 500 Sector ETFs: Recent Trends and Insights

The recent market landscape presents a dynamic stage for investors to assess the results of various S&P 500 sector ETFs. Scrutinizing these vehicles can reveal valuable patterns about certain sectors and their potential for profitability. For instance, the technology sector has consistently demonstrated robust performance, driven by innovation in artificial intelligence, cloud computing, and online retail. Conversely, the petroleum sector has faced fluctuations due to global events and changes in energy utilization. By allocating across different sectors, investors can mitigate risk and possibly enhance their investment's overall success.

- Considering the fundamental factors driving sector-specific movements is essential for making informed investment strategies.

- Staying abreast of the latest news and regulations that may influence specific sectors is also essential.

Constructing a Diversified Portfolio with S&P 500 Sector ETFs

A well-diversified portfolio is vital for navigating the complexities of the market. Investors can achieve broad exposure to various sectors of the economy by employing S&P 500 sector exchange-traded funds (ETFs). These ETFs track the performance of specific industry groups within the S&P 500 index, allowing investors to adjust their portfolios to align with their individual risk.

By distributing investments across different sectors, such as healthcare, investors can mitigate the impact of fluctuations in any single sector. Explore ETFs that display a wide range of sectors to maximize your portfolio diversification.

- Participating in S&P 500 sector ETFs can provide a efficient approach to diversifying your portfolio.

- Investigate the underlying holdings and performance history of each ETF before making an investment decision.

- Monitor your portfolio regularly and modify your allocations as needed to preserve your desired level of diversification.

Jaleel White Then & Now!

Jaleel White Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Tonya Harding Then & Now!

Tonya Harding Then & Now! Katey Sagal Then & Now!

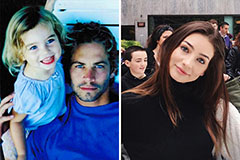

Katey Sagal Then & Now! Meadow Walker Then & Now!

Meadow Walker Then & Now!